What Is for 1095, & Should You Care? You probably got form 1095 sent to you in the mail, and you might be wondering whether you need it to file your taxes this year.

What Is for 1095, & Should You Care? You probably got form 1095 sent to you in the mail, and you might be wondering whether you need it to file your taxes this year.

Form 1095 is a new component of the Affordable Care Act (aka Obamacare) for the 2015 tax year. Form 1095 details your health insurance coverage, and there are 3 versions of the form: 1095-A, 1095-B, and 1095-C. Here’s an overview of each of the 1095 forms:

What Is Form 1095-C?

Form 1095-C is for people who have health insurance coverage through work or the government.

The Affordable Care Act requires certain businesses and employers to offer health insurance coverage to their employees, and every year employees must be notified of the health insurance available to them. This required statement of available coverage sent out by the employer is called “Form 1095-C.”

Form 1095-C includes details of coverage as well as the cheapest monthly premium option available to the employee under the plan.

Who sends out Form 1095-C, and when? Employers with 50 or more full-time employees are required by law to send out form 1095-C to their employees. These forms are sent out in January for taxes due that year. (Forms for 2015 will be sent out in January, 2016)

Do you need form 1095-C to file your taxes? No, you don’t need form 1095-C to file your income taxes.

What Is Form 1095-B?

While form 1095-C outlines what health insurance coverage is available to employees, form 1095-B provides details as to the actual coverage. It also details who in the employee’s family is covered under the health insurance plan.

Unlike form 1095-C, which is sent out by the employer, form 1095-B is sent directly from the insurance provider.

If an employer pays for workers’ medical bills themselves instead of paying premiums to an insurance company, they are known as “self-insured.” Because they are directly ensuring their employees, they will be responsible for sending out the 1095-B forms, often together with 1095-C

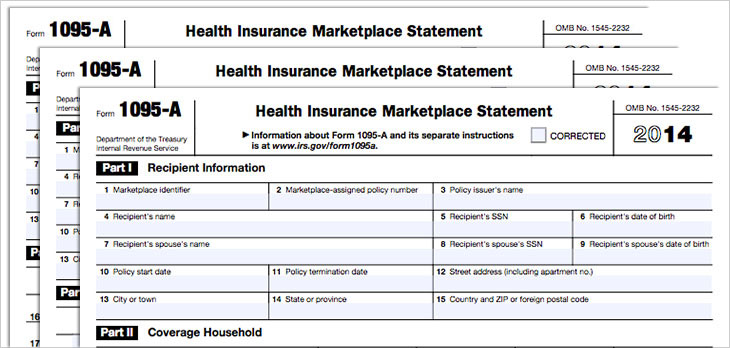

What Is Form 1095-A?

Form 1095-A is a “Health Insurance Marketplace Statement” for people with marketplace health insurance plans. The form is sent to the IRS with details about individuals who are enrolled in a healthcare plan through the Health Insurance Marketplace, as required by law.

Form 1095-A is sent to individuals so that they may take the Obamacare premium tax credit or to reconcile the existing credit on their tax returns with advance payments of the premium tax credit. (advance credit payments)

If you haven’t gotten your form 1095-A yet, you can view it online through the marketplace at healthcare.gov. You can also contact the Marketplace call center if you have an error on your form.

Do you need your form 1095-A to file your taxes? Yes, if you were sent form 1095-A, you’ll need it to file an accurate tax return.

If you’re filing your taxes yourself, please see our latest coupons for Turbo Tax and H&R Block to save up to 20% on all software editions!