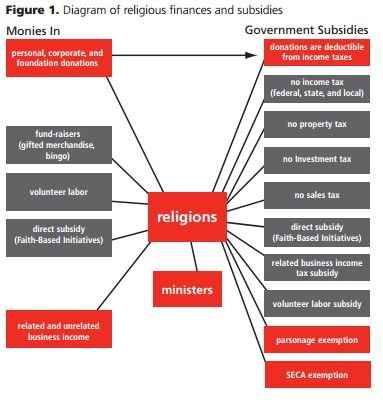

WASHINGTON D.C. – Churches and religious groups in the U.S. enjoy billions in tax breaks each year, though some researchers claim that such preferential treatment should be ended.

Churches in the USA receive approximately $71 billion in tax credits and tax breaks each year, according to the results of new research released on October 16th by the Secular Policy Institute.

The Institute found that each year religious groups receive $35.3 billion in federal income tax subsidies and $26.2 billion property tax subsidies.

Investment tax subsidies amounted to a total of $41 million per year.

Religious organizations also enjoyed approximately $6.1 billion in state income tax subsidies, along with $1.2 billion of parsonage, and $2.2 billion in the faith-based initiatives subsidy.

The estimates of the total subsidies enjoyed by religious groups did not take into account the amounts received from subsidies such as the sales tax subsidies, local sales and income tax subsidies, volunteer labor subsidy, and donor-tax exemptions.

Researchers at the Institute claimed that the tax subsidies which were unaccounted for could also amount to billions in tax savings.

Further, the Institute claimed that the subsidies should be cut for religious groups, or at least restricted to being applied solely to the charitable works of the marginalization.