H&R Block is one of the top names in tax services, and its online products empower taxpayers to file their own taxes at a low cost. H&R Block is very popular with filers age 65 and older, but is there an H&R Block senior discount?

If you are a senior citizen or AARP member here’s how to get the best discount possible for H&R Block online or software download.

H&R Block Discount for Seniors:

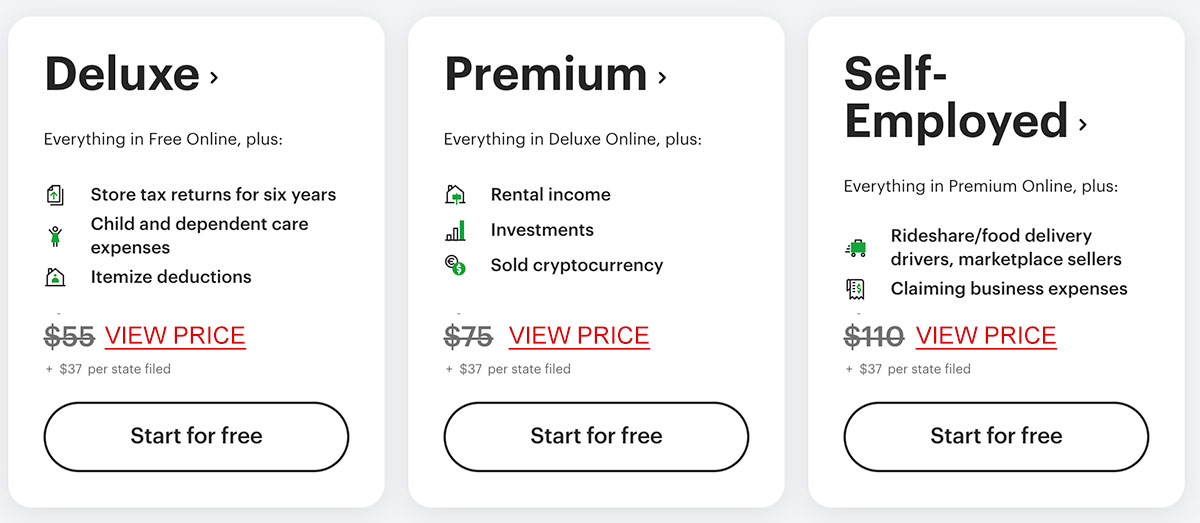

Currently, H&R Block does not offer a discount exclusively to seniors. However, we have been selected to promote this amazing H&R Block discount to taxpayers of all ages:

- H&R Block online up to 25% off

- H&R Block software download up to 20% off

If you file your taxes online, click below to see today’s discount pricing:

So, while this is not exclusively a senior discount, it’s the best deal for tax filers of all ages including students.

5 Tips for Senior Citizens Using H&R Block:

If you are a senior citizen, H&R Block is a great choice for filing your taxes efficiently online. Here are some tips for seniors filing with H&R Block:

- Gather all necessary information and documents: Before starting the tax filing process with H&R Block, it’s important to gather all the relevant information and documents. This might include things like W-2s or 1099s, social security statements, investment statements, and any receipts or other proof of deductions. Having everything organized and easily accessible will help make the process smoother and less stressful.

- Take advantage of H&R Block’s resources: H&R Block provides a variety of resources to help older taxpayers prepare and file their taxes. These include online tools and calculators, informative articles, and expert guidance from tax professionals. If you are a senior, make sure to take advantage of these resources to ensure that you’re maximizing your deductions and credits and avoiding any potential mistakes.

- Consider H&R Block’s senior-specific services: H&R Block offers specialized services for seniors that can help ensure that their unique tax needs are met. For example, they may offer personalized guidance on issues like social security benefits, retirement income, and medical expenses. Additionally, H&R Block has partnered with AARP to provide discounted services to members, which can be a great way for seniors to save money on their tax preparation fees.

- If you need help filing your taxes, consider IRS Tax Counseling for the Elderly (TCE), a free program providing tax assistance for seniors and individuals over age 60.

- The final, and best tip might be to use our exclusive promotion for seniors and filers of all ages, ensuring that you get the best discount possible on H&R Block.

More Discounts on Tax Preparation for Seniors?

If you would like to see more H&R block coupons we have them posted here. If you aren’t sure you’re going to file with H&R Block, then consider our TurboTax coupons here.

Tip: You might qualify for a tax credit for the elderly and disabled. Learn more at https://www.hrblock.com/tax-center/filing/credits/credit-for-elderly-or-disabled/

I hope you were able to get the best H&R Block for seniors, and thanks for stopping by Mighty Taxes!